LIQUID ALTERNATIVES

Quants is dedicated to offering superior liquid alternative funds to the world’s sophisticated investors.

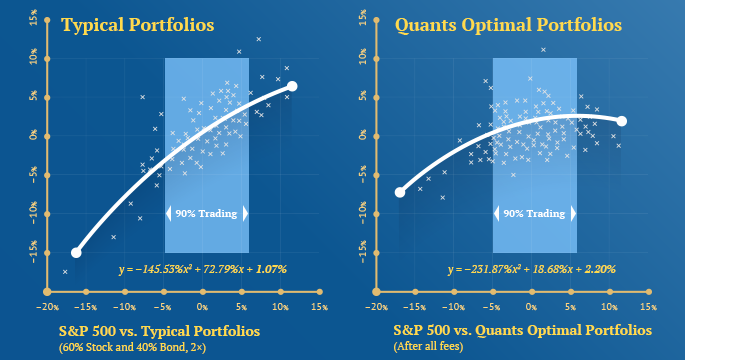

INDICES FOR BETTER RISK-ADJUSTED RETURNS

Quants has built proprietary quantitative risk indices for smart beta investing with derivative overlays that can improve the portfolios to potentially deliver two times better distribution of monthly returns without tactical trading.

OPTIMAL RISK MANAGEMENT TECHNOLOGY

Investing more than a decade of research on its risk and return optimization technology, Quants has extensive quantitative risk modeling and execution experience in US securities with derivative overlays, generating better risk-adjusted returns for its clients.

UPCOMING SMART BETA BUILDING BLOCKS

Exchange Traded Funds (ETFs) as the smart beta building blocks for better risk management with derivative overlays.

UPCOMING QUANTS+ ROBO-ADVISOR PLATFORM

Quants is developing an automated investment platform with superior risk management features by using Quants Risk Indices and ETFs to enable smart beta investing in any portfolio.